Enjoy a Slice of Customer Data Analytics Pie

Enjoy a Slice of Customer Data Analytics Pie

Today, it’s March 14—commonly known as International Pi (π) Day. Pi is an amazing mathematical constant because it articulates the unique ratio between the circumference of a circle and its diameter. Supercomputers have calculated it to over 60 trillion decimal places but most of us struggle to get beyond 3.14. Fun fact, world record holder Akira Haraguchi famously recited Pi to 100,000 digits from memory in 2006. This chosen date makes more sense when you apply the baffling (to a Brit) American date notation system of putting the month before the day i.e., 3-14.

You may be asking what pi has to do with customer data analytics. Well, bear with me and you’ll soon be craving your own slice of the pi(e).

The Power of Pi

Pi is an infinitely long number! But nevertheless, we use Pi all the time to help us calculate so many things such as the circumference of a circle (2πr) or the volume of a sphere (4/3 π r3). Both of these equations have been etched into my brain from my math lessons 4 decades ago. NASA uses it to calculate trajectories of spacecraft, engineers to design buildings, biochemists to understand DNA, and clock designers to fine-tune pendulums.

The Hypocritical Quandary

However, on a practical everyday level, we use a truncated approximation of Pi to perform these calculations. Systems like Excel only calculate to a measly 14 decimal places: 3.14159265358979. And yet, the results we derive are deemed perfectly adequate. We don’t question the integrity of our analysis or the results of our equation. So, why don’t we think similarly when it comes to customer data and analyzing customer data?

For example, there is an ongoing paranoia around transcript accuracy and the associated distrust of derived insights if a transcription is not 100% accurate. We seem happy to calculate the area of a circle using a crude “3.14” figure but not happy to trust a transcript that is say 90% accurate. What is more relevant is if the degree of accuracy is sufficient to give confidence in the results and, in my mind, speech analytics engines are at that point now. Yes, the transcript might not be 100% accurate but if you read it, you can understand what was going on in the conversation and should be able to trust the insights that are derived.

Given the potential to leverage customer analytics for tackling unknowns in contact centers and boost agent productivity, customer engagement, and customer loyalty it’s time to worry less about ultimate accuracy and take a bite out of the initially intimidating pi that is contact center analytics.

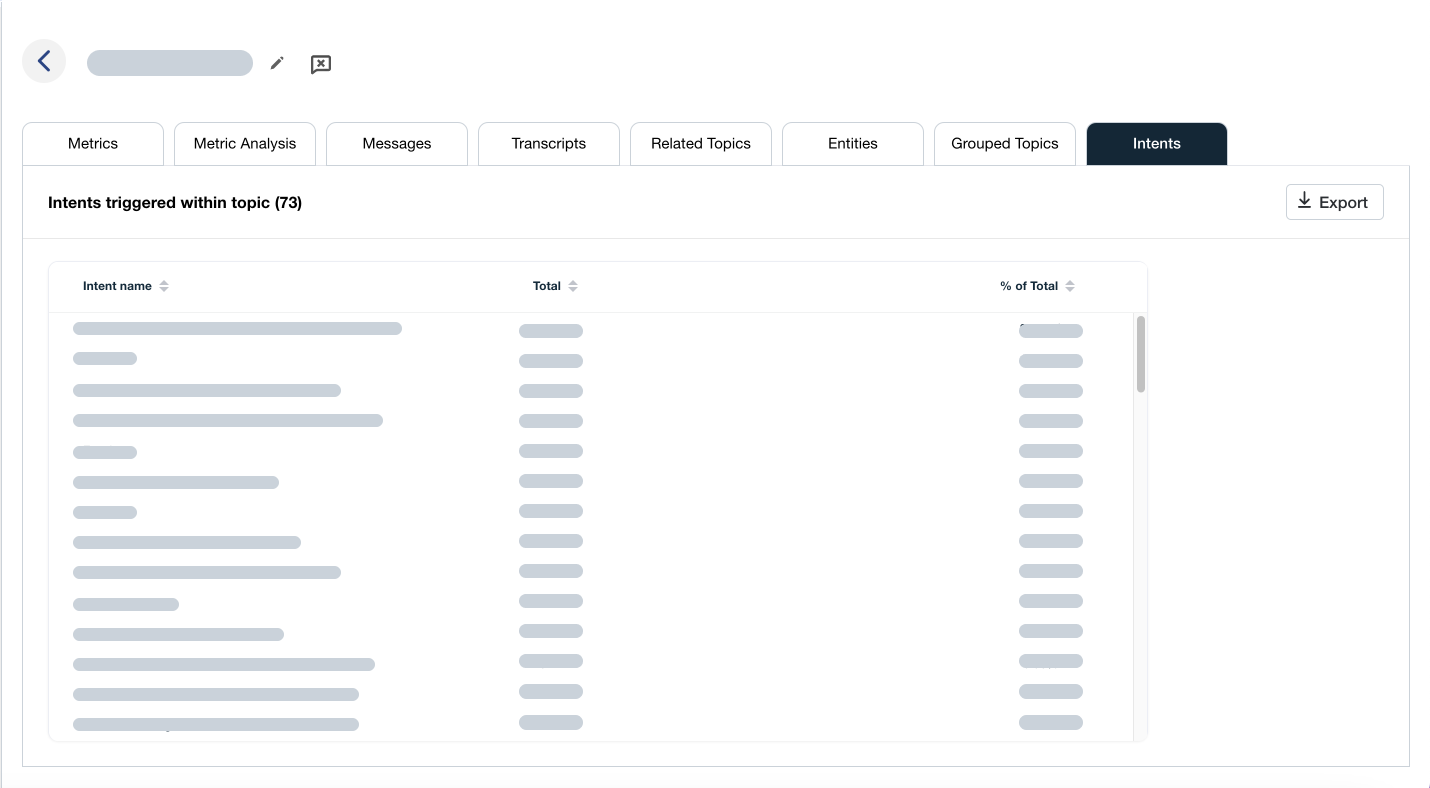

Here are 6 ways to implement customer analytics tools to help contact centers dive into the unknown:

1. Eliminate Human Bias

First, focus on the potential problem of human bias. The most common use of applying customer analytics to transcripts is the ability to search for keywords and phrases linked to specific, pre-determined categorizations such as churn risk, compliance, or upsell. These are important activities but rely heavily on human input to create and refine the phrase library that relates to each topic. To use an analogy, it’s like saying, “here are the needles we’re looking for in the haystack.”

The problem is some of these needles might not be top of mind in the human analyst and therefore become overlooked. Basic keyword trending can help a little. For example, ‘what words were spoken more this week than last week’ but it’s not ideal. It’s much better to be able to automatically find the key topics and library of associated phases using Machine Learning (ML), thereby removing any potential human bias or human error. Going back to my previous analogy think of this as, “blowing away all the straw and seeing what needles you’re left with.” That’s exactly where customer analytics comes into play.

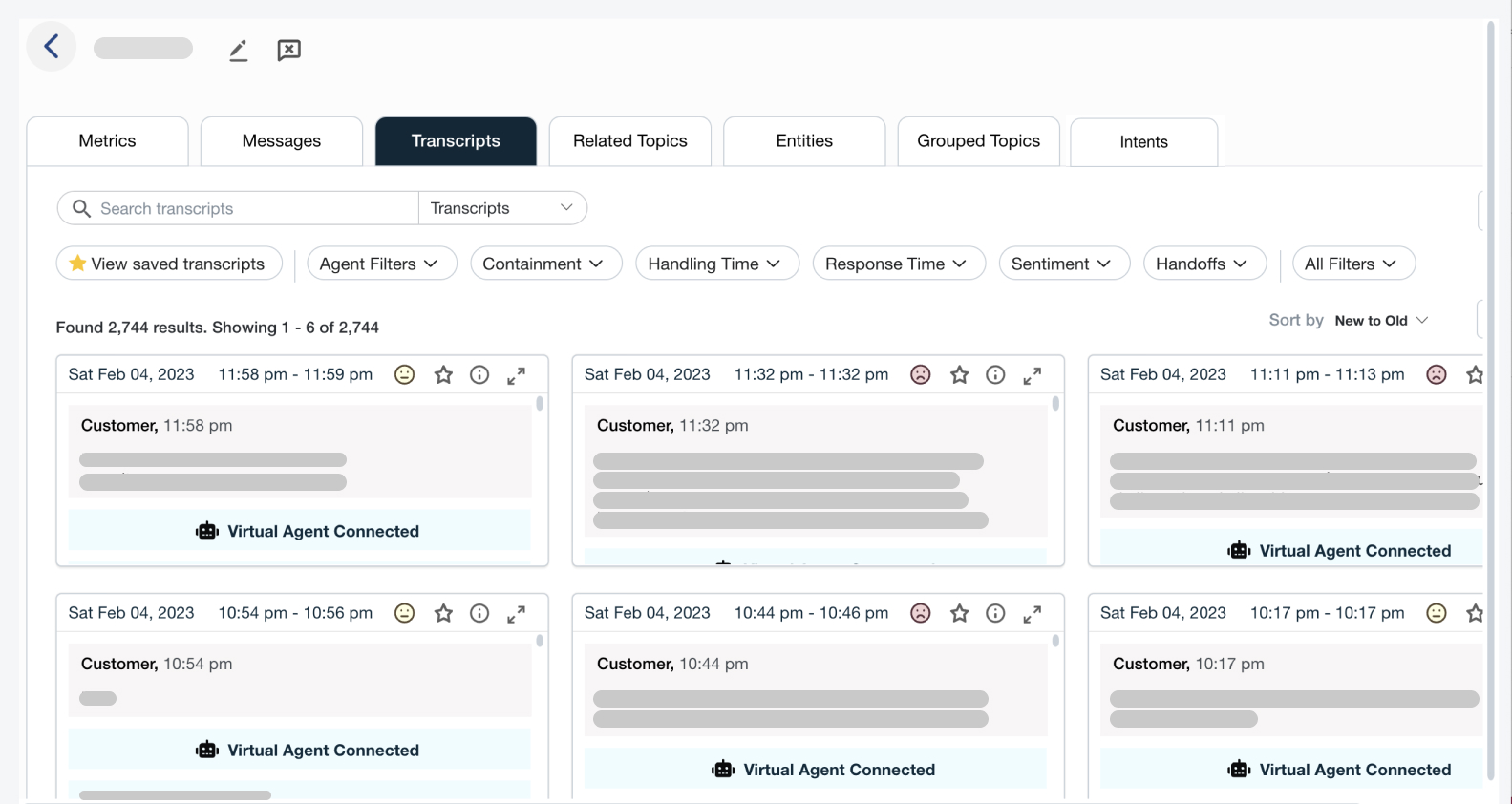

2. Create Conversational Clarity

The average organization only analyzes 2% of all customer interactions, and even that small percentage is mostly random quality assurance (QA) checks. So, what happens is the QA team selects a few interactions a month to evaluate and then they try to make business decisions based on just that small amount of information. This means the other 98% of interactions with that valuable unfiltered and unbiased customer data just sit there on the shelf untouched. The beauty of customer analytics is that they analyze 100% of customer interactions. This makes the unknown known, allowing for better, more informed business decisions.

3. Ease Customer Effort

Customers expect their journey to be seamless and synced up. If an organization is too difficult to do business with, they are likely to look elsewhere for their new favorite sneaker or the latest gadget. Implementing customer analytics keeps customers on your side by identifying the root causes of poor customer experiences. One great example is using customer analytics to truly understand the voice of the customer (VoC). It analyzes every single customer interaction whether that’s conversations with agents, post-call evaluations, surveys, and other customer journey or CRM data.

In this way, contact centers can really start to fathom out what customers want now and even predict what they will want in the future. When times are tough, customer data analytics becomes a huge competitive differentiator. If you can quickly pick up on the warning signs, such as multiple apologies, escalations, or regulator mentions, this allows agents to stay one step ahead. They can proactively call disgruntled customers to nip potential problems in the bud.

4. Reduce Contact Load

Harnessing customer analytics identifies repeat contacts or instances of customer demand that are avoidable and lead to unnecessary costs. Good examples are contacts that are caused by other departments and could be handled elsewhere in the organization or they are perfect candidates for self-service—simple for customers, simple for agents. With the ability to spot time-consuming and expensive contacts automatically, customer data analytics are a soothing remedy for some of the more common headaches caused by long handle times, high hold times, unnecessary transfers, and silent time.

Why not utilize the same tools to fix broken and costly processes while remaining fully compliant at all times? Are your compliance statements being read and can you isolate high-risk (and low-risk) contacts in a flash? In my experience working with existing customers, navigating to the precise point in an interaction improves the efficiency of quality assurance (QA) and compliance by 30-40%.

5. Coach Employees in the Right Direction

When agents have meaningful opportunities to learn something new and have a clearly defined career path, their engagement levels increase exponentially. Today’s sophisticated analytics are designed to take away the unknowns that hinder agent morale, performance, and development. They are guaranteed to supercharge your contact center team by delivering a personalized and meaningful view of their performance wherever they are. For example, dashboards powered by analytics give agents all the visibility they need to create their own self-assessments and personal development plans.

Replace random monitoring with targeted performance coaching by using customer analytics to select contacts that are relevant to each employee. You can automatically tag contacts and push these to agents and supervisors for additional coaching. Remember, what goes on behind the scenes is just as important as what happens on the front line. Use desktop and speech/text analytics to identify and improve systems that are slow or poorly designed.

6. Build Brand Intelligence

Let your data drive value across the business with real-time insights. While employing in-the-moment data insights boosts decision-making in the contact center, it also helps build a solid and cohesive framework for certainty, trend-spotting, and action planning across the wider organization.

Dive into your data and share insights to give everyone the opportunity to shine. Powerful CX insights from within the contact center can help the marketing team understand brand awareness, competitor influence, and the overall effectiveness of their marketing campaigns. Finance could benefit from interaction insights into billing issues, refunds, and credits. Sales can quickly identify new opportunities for renewals, referrals, and cross-sells. Sharing a slice of the pie that you’ve gained from customer data analytics on customer-agent interactions helps the whole brand step away from unknowns and guessing, to build greater brand intelligence and customer loyalty.

Take a Bite of Customer Data Analytics

Customers have long memories, and their expectations are constantly rising. What better time to unearth what they really think and the service you’re really delivering? Although the idea of using customer data analytics may seem as daunting as calculating Pi, it doesn’t need to be. Analytics can sift through the piles of customer data your contact center collects to help make the unknown known. Just look at what these three customers achieved with the benefits of data analytics!

So, let’s not worry about the minute details of accuracy. Let’s focus on getting the most valuable insight from our data. I’ll have a slice of that pie.

Stay connected with all things CX by visiting The CX Lab.