Insurance Companies:

4 Must-Have Tips to Improve Customer Experience

A positive contact center experience makes a customer twice as likely to renew their insurance policy.

Insurance carriers know the immense impact customer experience has on retention, revenue and profitability. And nowhere is a positive experience more important than insurance contact centers. Fielding thousands of calls every day, it is the central hub of an insurance company.

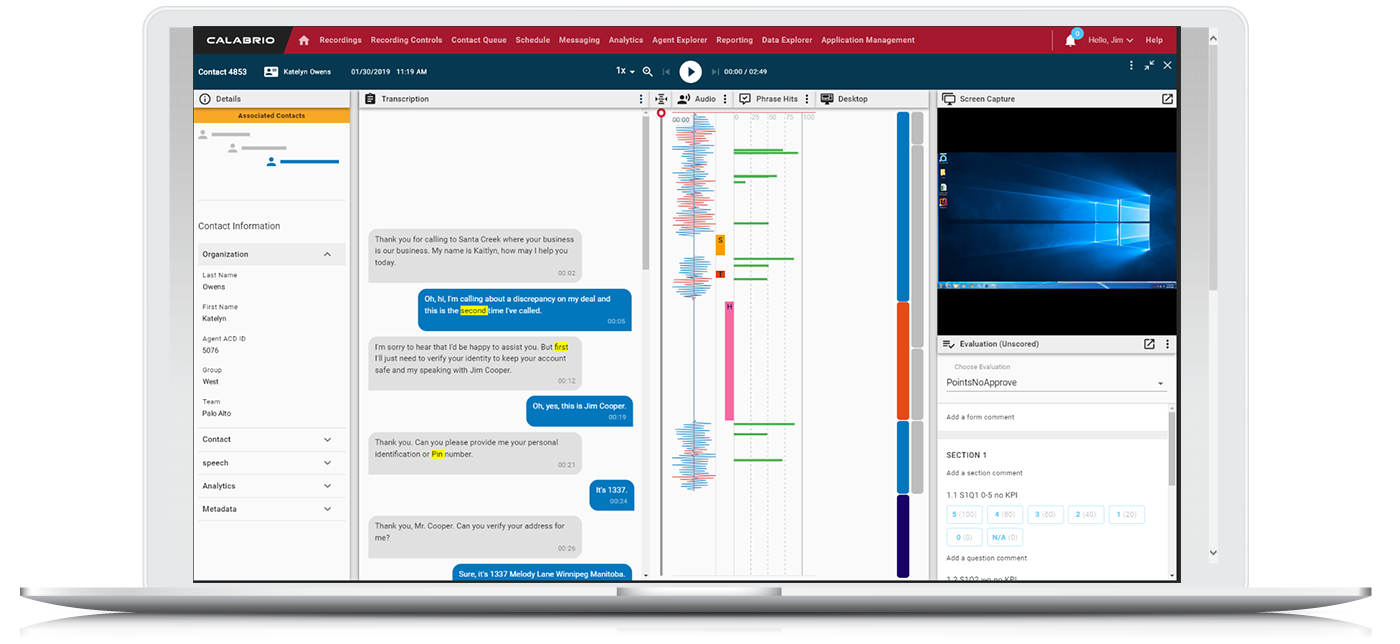

The good news is insurance call centers are sitting on a wealth of voice-of-the-customer information. The bad news is this data is largely untapped – with only 2% of conversations analyzed on a routine basis.

Download our tip sheet to learn four ways to improve the customer experience. It’s a must-read for business leaders looking to tap into the remaining 98% of your contact center data and leverage key insights to drive growth.