Customer Experience Strategies

for Insurance Organizations

for Insurance Organizations

Scalable, Robust Workforce Optimization

and Powerful Voice of the Customer Analytics

for Your Insurance Contact Center

and Powerful Voice of the Customer Analytics

for Your Insurance Contact Center

Customer Experience Strategies for Insurance Organizations

Scalable, Robust Workforce Optimization

and Powerful Voice of the Customer Analytics

for Your Insurance Contact Center

and Powerful Voice of the Customer Analytics

for Your Insurance Contact Center

In the insurance industry, contact centers now own the customer experience and customer expectations keep rising.

Today, one in four customers will leave their insurance provider based on a bad contact center experience. Therefore, it is paramount insurers work hard to make sure their contact center delivers an exceptional customer experience.

In fact, a one percent increase in customer retention amounts to a million-dollar increase in annual premiums. And customers are twice as likely to renew their insurance policy after a positive contact center experience.

Providing an outstanding customer experience begins with transforming raw customer data into meaningful customer insights.

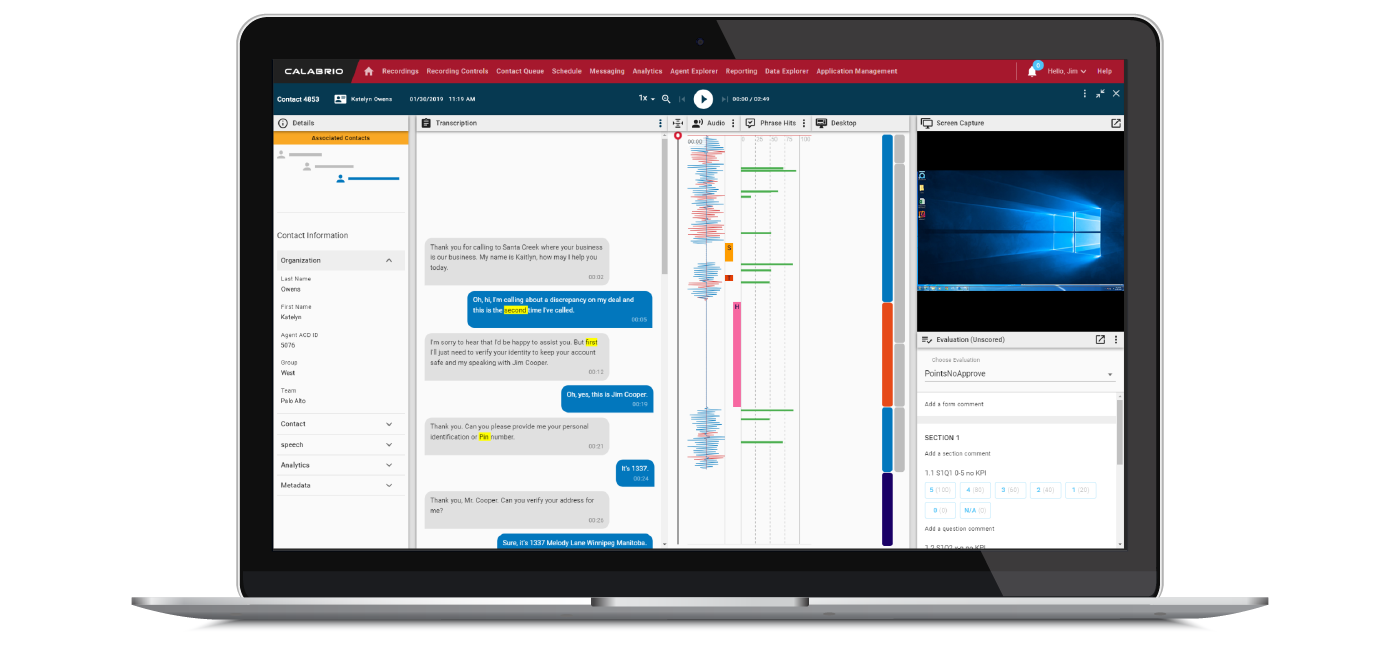

With Calabrio, you can analyze 100% of customer interactions, from all channels, to clearly understand trends and act on them. Identify warning signs of customer defection and train agents how to handle retention efforts. Utilizing powerful AI tools, Calabrio gives you sentiment scores for every customer interaction, allowing you to quickly identify root cause of positive and negative interactions.

Now is the time to unlock the customer insights buried within your contact center. Continue reading below to discover how Calabrio has helped insurance providers including AXA, Americo, Erie Insurance, AmTrust and Pacific Life improve their customer experience up to 25% while increasing contact center productivity by more than 30%. Plus, learn eight strategies insurance companies can use to improve the contact center customer experience.

What can we help you with?

Call Recording

Capture and retrieve every call quickly and accurately.

Quality Management

Evaluate every citizen interaction to gain powerful insights.

Workforce Management

Improve predictability and performance to optimize staffing.

Calabrio Analytics

Synchronize data for unprecedented visibility and control.

Insurance Case Studies for Calabrio ONE

Insurance Companies: 8 Strategies to Improve the Customer Experience

A one percent increase in customer retention equals a one million dollar increase in annual premiums. Learn how your call center can increase retention.

AXA Seguros Mexico Sees ROI in Just 3-6 Months

AXA Seguros Mexico replaced Nice with Calabrio ONE to increase call center growth and productivity.

4 Must-Have Tips to Improve Customer Experience

A positive call center experience makes a customer twice as likely to renew their insurance policy. Learn four easy ways to improve customer experience.